Introduction to Cryptocurrency Surge

Understanding Cryptocurrency Basics

Cryptocurrency represents a revolutionary shift in the financial landscape. It is a digital or virtual currency that uses cryptography for security. This technology ensures that transactions are secure and that the creation of new units is controlled. Many people are intrigued by its potential.

The surge in cryptocurrency popularity can be attributed to several factors. First, the increasing acceptance of digital currencies by mainstream businesses has fueled interest. For instance, major companies now accept Bitcoin as a form of payment. This trend is significant.

Second, the potential for high returns attracts investors. Cryptocurrencies have shown remarkable price increases over myopic periods. This volatility can be appealing.

Lastly, the decentralized nature of cryptocurrencies offers an alternative to traditional banking systems. Users appreciate the control it providws over their finances. This independence is empowering.

In summary, understanding the basics of cryptocurrency is essential for anyone looking to navigate this evolving market. Knowledge is power.

The Rise of Digital Assets

The rise of digital assets has transformed the investment landscape significantly. Investors are increasingly allocating capital to cryptocurrencies and blockchain-based assets. This shift reflects a growing recognition of their potential for high returns. Many see this as an opportunity.

Moreover, the proliferation of decentralized finance (DeFi) platforms has democratized access to financial services. These platforms enable users to lend, borrow, and trade without intermediaries. This innovation is revolutionary.

Additionally, institutional interest in digital assets has surged. Major financial institutions are now incorporating cryptocurrencies into their portfolios. This trend signals a maturation of the market.

Furthermore, regulatory developments are shaping the future of digital assets. Governments are beginning to establish frameworks that provide clarity and security for investors. This is a positive step.

In essence, the rise of digital assets represents a paradigm shift in finance. Understanding this evolution is crucial for informed investment decisions. Knowledge is essential.

Factors Driving Market Volatility

Market volatility in the cryptocurrency sector is influenced by several key factors. First, the speculative nature of digital assets drives rapid price fluctuations. Investors often react emotionally to market news. This creates instability.

Second, regulatory changes can significantly impact market sentiment. Announcements from governments regarding cryptocurrency regulations can lead to sharp damage movements. Such news can be unpredictable.

Third, technological advancements and security breaches also play a crucial role. Innovations can enhance market confidence, while hacks can trigger panic selling. Trust is vital in this space.

Additionally, macroeconomic factors, such as inflation and interewt rates, affect investor behavior. Economic uncertainty often leads to increased interest in alternative assets. This trend is noteworthy.

In summary, understanding these factors is essential for navigating the volatile cryptocurrency market. Awareness is florida key for informed decision-making.

Importanve of Market Awareness

Market awareness is crucial for anyone involved in cryptocurrency trading. Understanding market dynamics allows investors to make informed decisions. Knowledge empowers individuals to navigate volatility effectively. This is essential for success.

Moreover, staying updated on news and trends can significantly impact investment outcomes. Market sentiment often shifts rapidly based on external factors. Awareness of these changes can prevent costly mistakes. This is a valuable insight.

Additionally, recognizing the influence of social media and online communities is important. These platforms can amplify market movements and create trends. Investors should monitor discussions and sentiment closely. This can provide a competitive edge.

Furthermore, understanding technical analysis can enhance decision-making. Analyzing price charts and indicators helps identify potential entry and exit points. This skill is beneficial for traders.

In essence, cultivating market awareness is vital for navigating the complexities of cryptocurrency. It fosters better investment strategies.

Analyzing Market Trends

Historical Price Movements

Historical price movements in cryptocurrency provide valuable insights into market behavior. Analyzing these trends helps investors identify patterns and potential future movements. For instance, Bitcoin’s price surged from under (1,000 in early 2017 to nearly )20,000 by December of the same year. This dramatic increase illustrates the volatility inherent in the market. Such fluctuations are noteworthy.

Additionally, the subsequent correction in early 2018 saw Bitcoin’s price drop to around $3,200. This decline highlights the risks associated with speculative trading. Understanding these cycles is essential.

Moreover, examining altcoin performance during Bitcoin’s price changes can reveal correlations. For example, many altcoins tend to follow Bitcoin’s lead, experiencing similar price movements. This relationship is significant.

Furthermore, utilizing technical analysis tools, such as moving averages and Fibonacci retracement levels, can enhance trend analysis. These tools assist in identifying support and resistance levels. This knowledge is crucial for making informed trading decisions.

In summary, historical price movements serve as a foundation for understanding market trends. Awareness of these patterns is vital for strategic investment. Knowledge is key.

Current Market Sentiment

Current market sentiment plays a crucial role in shaping investment decisions within the cryptocurrency space. Investors often gauge sentiment through various indicators, including social media trends and market news. These factors put up significantly influence price movements. Awareness is essential.

Moreover, the Fear and Greed Index is a popular tool for assessing market sentiment. This index quantifies emotions and sentiments driving market behavior. A high greed level may indicate overvaluation, while fear can signal potential buying opportunities. Understanding this index is beneficial.

Additionally, sentiment analysis can reveal shifts in investor confidence. For instance, positive news regarding regulatory developments can lead to increased buying activity. Conversely, negative news can trigger panic selling. This dynamic is important to monitor.

Furthermore, community discussions on platforms like Twitter and Reddit can provide insights into prevailing attitudes. Engaging with these communities can enhance understanding of market psychology. This engagement is valuable.

In summary, analyzing current market sentiment is vital for making informed investment choices. Knowledge of sentiment trends can lead to better strategies. Awareness is key.

Technical Analysis Tools

Technical analysis tools are essential for evaluating market trends in cryptocurrency. These tools help investors identify potential entry and exit points. Commonly used indicators include moving averages, which smooth out price data to identify trends. This method is effective.

Another important tool is the Relative Strength Index (RSI). The RSI measures the speed and change of price movements. It helps determine overbought or oversold conditions. This insight is valuable.

Additionally, Fibonacci retracement levels are widely utilized. These levels indicate potential reversal points based on historical price movements. Traders often use them to set target prices. This strategy can enhance decision-making.

Chart patterns, such as head and shoulders or triangles, also provide insights into market behavior. Recognizing these patterns can signal potential price movements. This knowledge is crucial.

Incorporating these technical analysis tools into trading strategies can improve outcomes. Understanding their application is key for successful trading.

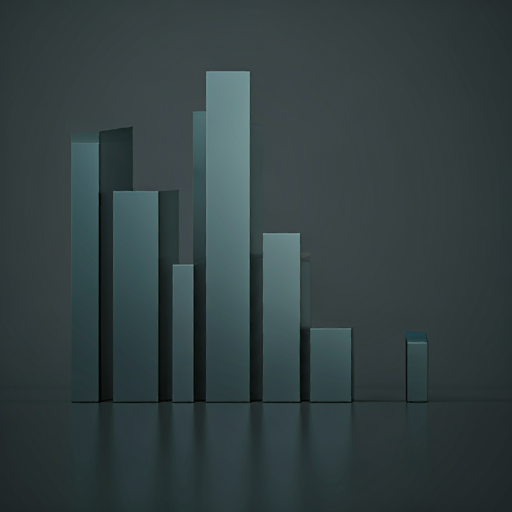

Identifying Bull and Bear Markets

Identifying bull and bear markets is crucial for effective trading strategies. A bull market is characterized by rising prices and investor optimism. This environment encourages buying, as traders anticipate further gains. Understanding this trend is essential.

Conversely, a bear market features declining prices and widespread pessimism. In this scenario, investors often sell to minimize losses. Recognizing these conditions can help traders adjust their strategies. This awareness is vital.

Several indicators can assist in identifying these market phases. For instance, a sustained increase in the price of an asset over several months typically signals a bull market. Conversely, a consistent decline over the same period indicates a bear market. This pattern is significant.

Additionally, analyzing trading volume can provide insights. Increased volume during price rises often confirms a bull market. In contrast, high volume during price declines may signal a bear market. This correlation is important.

In summary, understanding how to identify bull and bear markets enhances trading effectiveness. Knowledge of market conditions is key for success. Awareness is power.

Investment Strategies in a Volatile Market

Diversification of Porgfolio

Diversification of a portfolio is a fundamental strategy for managing risk in volatile markets. By spreading investments across various asset classes , investors can reduce the impact of poor performance in any single investment. This approach enhances overall portfolio stability. It is a smart move.

Investors often include a mix of cryptocurrencies, stocks, bonds, and commodities. Each asset class reacts differently to market conditions. This variety can cushion against market downturns. It is essential to balance risk.

Additionally, geographic diversification can further mitigate risk. Investing in international markets exposes investors to different economic conditions. This strategy can enhance growth potential. It is a valuable consideration.

Moreover, regularly rebalancing the portfolio is crucial. This process involves adjusting the allocation of assets to maintain the desired risk level. It helps ensure that the portfolio aligns with investment goals. This practice is important.

In summary, a well-diversified portfolio can provide a buffer against market volatility. Understanding diversification is key for effective investment strategies.

Long-term vs. Short-term Investments

Long-term and short-term investments represent distinct strategies in the financial landscape. Long-term investments typically involve holding assets for several years, allowing for growth and compounding returns. This approach can mitigate the effects of market volatility. Patience is key.

In contrast, short-term investments focus on quick gains, often within days or months. Traders capitalize on market fluctuations to realize profits rapidly. This strategy requires constant monitoring and warm decision-making. It can be stressful.

Investors should consider their risk tolerance when choosing between these strategies. Long-term investors may prefer stability and gradual growth, while short-term traders may seek higher returns with increased risk. Understanding personal goals is essential.

Additionally, a balanced approach can be beneficial. Combining both strategies allows investors to take advantage of immediate opportunities while building wealth over time. This hybrid strategy can enhance overall portfolio performance. It is a smart choice.

Ultimately, the decision between long-term and short-term investments depends on individual circumstances and market conditions. Awareness of both strategies is crucial for effective investment planning.

Risk Management Techniques

Risk management techniques are essential for navigating volatile markets effectively. One common method is setting stop-loss orders, which automatically sell an asset when it reaches a predetermined price. This strategy helps limit potential losses. It is a protective measure.

Another technique involves position sizing, which determines the amount of capital allocated to each investment. By diversifying investments and limiting exposure to any single asset, investors can reduce overall risk. This approach is prudent.

Additionally, employing a risk-reward ratio can guide investment decisions. This ratio compares the potential profit of a trade to its potential loss. A favorable ratio indicates a more attractive investment opportunity. This analysis is crucial.

Furthermore, regularly reviewing and adjusting the portfolio is important. Market conditions change, and so should investment strategies. This ongoing assessment helps maintain alignment with financial goals. It is a necessary practice.

In summary, effective risk management techniques can enhance investment outcomes in volatile markets. Understanding these strategies is vital for informed decision-making.

Utilizing Stop-Loss Orders

Utilizing stop-loss orders is a critical strategy for managing risk in volatile markets. A stop-loss order automatically sells an asset when its price falls to a specified level. This mechanism helps protect against significant losses. It is a safety net.

Investors can set stop-loss orders based on their risk tolerance and market conditions. For example, a common approach is to set the stop-loss at a percehtage below the purchase price . This method allows for some price fluctuation while limiting potential losses. It is a practical approach.

Additionally, trailing stop-loss orders can be beneficial. These orders adjust automatically as the price of the asset increases, locking in profits while still providing downside protection. This flexibility is advantageous.

Moreover, using stop-loss orders can reduce emotional decision-making. By predefining exit points, investors can avoid panic selling during market downturns. This discipline is essential for long-term success.

In summary, incorporating stop-loss orders into investment strategies enhances risk management. Understanding their application is vital for navigating market volatility.

The Future of Cryptocurrency

Emerging Technologies and Innovations

Emerging technologies and innovations are shaping the future of cryptocurrency. Blockchain technology continues to evolve, enhancing security and transaction speed. This improvement is crucial for wider adoption. It is a significant development.

Decentralized finance (DeFi) platforms are gaining traction, offering financial services without intermediaries. These platforms enable lending, borrowing, and trading directly between users. This model increases accessibility. It is empowering.

Additionally, non-fungible tokens (NFTs) are revolutionizing digital ownership. By providing proof of authenticity, NFTs create new markets for digital art and collectibles. This innovation is noteworthy.

Moreover, advancements in scalability solutions, such as layer-2 protocols, are addressing network congestion. These solutions improve transaction throughput and reduce fees. This enhancement is essential for user experience.

In summary, the future of cryptocurrency is driven by technological advancements. Understanding these innovations is vital for investors.

Regulatory Developments

Regulatory developments are crucial for the future of cryptocurrency. Governments worldwide are increasingly focusing on establishing frameworks to govern digital assets. This regulatory clarity can enhance investor confidence. It is a necessary step.

For instance, the European Union is working on the Markets in Crypto-Assets (MiCA) regulation. This legislation aims to create a comprehensive regulatory framework for cryptocurrencies and related services. Such initiatives can promote innovation while ensuring consumer protection. This balance is important.

In the United States, regulatory bodies like the SEC and CFTC are also taking action. They are defining the legal status of cryptocurrencies and enforcing compliance. This oversight can help mitigate fraud and market manipulation.

Moreover, international cooperation is becoming more prevalent. Organizations like the Financial Action Task Force (FATF) ar developing guidelines for member countries. These guidelines aim to combat money laundering and terrorist financing in the crypto space. This collaboration is essential.

Overall, regulatory developments will significantly shape the cryptocurrency landscape. Understanding these changes is vital for investors and stakeholders.

Predictions for Market Growth

Predictions for market growth in cryptocurrency indicate a positive trajectory. Analysts forecast that the market capitalization of digital assets will continue to expand. This growth is driven by increasing institutional adoption. It is a significant trend.

Furthermore, advancements in blockchain technology are expected to enhance scalability and efficiency. These improvements can attract more users and investors. This potential is noteworthy.

Additionally, the integration of cryptocurrencies into traditional financial systems is gaining momentum. More financial institutions are offering crypto-relatrd services. This trend can further legitimize the market. It is an important development.

Moreover, the rise of decentralized finance (DeFi) platforms is likely to contribute to market growth. These platforms provide innovative financial solutions without intermediaries. This model appeals to a broader audience. It is a game changer.

Overall, the future of cryptocurrency appears promising, with various factors supporting market expansion. Understanding these predictions is essential for informed investment decisions.

Community and Ecosystem Impact

Community and ecosystem impact play a vital role in the future of cryptocurrency. Active communities drive innovation and adoption of digital assets. They provide support and resources for new projects.

Moreover, decentralized autonomous organizations (DAOs) are emerging as a new governance model. DAOs allow community members to participate in decision-making processes. This structure enhances transparency and accountability. It is a significant shift.

Additionally, educational initiatives within the community foster understanding of cryptocurrency. Workshops, webinars, and online courses help demystify complex concepts. This knowledge empowers individuals. It is crucial for growth.

Furthermore, partnerships between projects and traditional businesses are increasing. These collaborations can enhance the utility of cryptocurrencies in everyday transactions. This integration is beneficial.

Overall, the community and ecosystem surrounding cryptocurrency are pivotal for its evolution. Engaging with these networks is vital for success.